25+ Online pension calculator

To simplify the calculation we assume annuity rates will be 6 per cent and return from NPS will be 10 per cent. National Pension Scheme vs Atal Pension Yojana APY.

Make Your Retirement Comfortable With The 8 Year Gis Strategy Ed Rempel

Income Tax Calculator for FY 2020-21 AY 2021-22 Excel Download Calculators Budget Budget 2020 Income tax Investment Plan Tax Return Taxes Download Excel based Income Tax Calculator for FY 2020-21 AY 2021-22 incorporating new and existing tax regimeslabs.

. Call For NRI customers All Days. If youre using a Legal General Aegon Aon PensionBee Prudential ReAssure or Sun Life Financial of Canada pension pot to fund your retirement plan you can call us free to get a Pension Annuity quote for a smaller amount Legal General. National Pension Scheme NPS which is regulated and administered by the Pension Fund Regulatory and Development AuthorityPFRDA is a reliable government-backed plan.

There are no specific 7th pay commission recommendations on this subjectNo. 2022-09-09 132625 Time Span Calculator 1993 2022-09-08 190105 USA Full Retirement Date Calculator 4 2022-09-05 015017 Astronomy no shadow day calculator 1 2022-09-03 211530 Chemical equation balancer 82. Inflation - The calculator allows for annual investment growth of 2 5 or 8.

Request call back Missed Call 9606112099. By design the Canada Pension Plan is intended to provide you with approximately 25 per cent of your retirement income. Contributions you make to a pension will normally receive basic rate tax relief even if you dont pay tax.

The same can be processed to furnish- Childs marriage Higher education Buying house or medical emergencies. Pension fixation has been suggested by the 7th Central Pay Commission for civil employees inclusive of Central Armed Police Forces personnel whose retirement date was prior to January 1 2016. Her Majesty Queen Elizabeth II 21 April 1926 8 September 2022.

9000 per month and the maximum amount of pension is 125000 per month. Lic Money Back 20 years Maturity Calculator. Check the calculations to see how much tax youll pay and the.

The Pension Tracing Service is a free government service. Watch the ServicetoCivvy short video optional. HDFC Life Guaranteed Pension Plan policy in India offers wide range of annuity options provides a regular guaranteed income for lifetime.

Once you enter your age and pension pot amount well show. Why you must calculate your CPP benefits CPP benefits are taxable income. Consequently a brokerage charges calculator greatly streamlines the process of figuring out the cost of a trade.

To determine their cost of trading a person would need to enter the following data into an online brokerage calculator. But with the introduction of eNPS opening an online NPS account takes no more than 30 minutes. LIC New Jeevan Nidhi Plan.

If you have reached age 75 and have insufficient lifetime allowance this percentage will be lower. It has made the process more seamless time-saving and easy. After the implementation of the 7th pay commission the minimum pension is Rs.

You can phone the Pension Tracing Service on 0800 731 0193 or use the link below to search their online directory for contact details. If one joins NPS at the age of 35 he or she needs to invest over Rs 28500 monthly for the next 25 years for a fixed pension of Rs 76260 after retirement. 1222 EDT 25 June 2008 Updated.

125 225 or 325 you can see how your pension might grow in the future if earnings growth exceeds price inflation by the given amounts for each year you remain in. - Buying price of the stock - Selling price of the stock - Number of shares to be bought sold. The charges for your plan may be different.

On the other hand if you received that enhanced EPS pension the 8 inflation you can change it as desired in the calculator will reduce the purchasing power of this pension by 50 in 83 years. For Online Policy Purchase New and Ongoing Applications Call All Days from 9 am to 9 pm Toll free 1800-266-9777. Click on and read the Terms.

LIC Jeevan Akshay VI Plan 810. 0759 EDT 21 March 2018. Please suggest an idea for a new online calculator.

It searches a database of more than 200000 workplace and personal pension schemes to try to find the contact details you need. Pension Drawdown results are available on our calculator for ages 55-74. Pension pot calculator - see how much you need to save for retirement.

Under current legislation you can take up to 25 of your pension tax-free as a lump sum or in portions. A maximum of 25 of the accumulated amount can be partially withdrawn after completion of at least 5 years of continuous contributions in the fund. LIC Maturity Calculator calculates the maturity amount based on sum assured bonusFABCalculate premium using Lic maturity calculator for jeevan anand 815.

By Richard Browning For Thisismoneycouk. For calculations with the CPP enhancements included the CPP Calculator will provide the same result as if you hired Doug to make the calculations. The returns may vary depending on market conditions.

The amount you could take for your 25 tax-free lump sum. Use our free pension calculator to estimate your retirement income from workplace schemes private pension contributions or call us free on 0800 011 3797. Retirement Benefits for Central Government Employees.

Tell us how much tax-free and taxable cash you would like to take. Lic Money Back 25 years Maturity calculator. The calculations assume that 25 of any lump sum from a non-drawdown pension is available tax free.

Regular contributions are assumed to increase in line with inflation and to be paid monthly in advance. If you leave a description of what you want to calculate a member of. For every 1 you invest the taxman can put in another 25 pence.

The duration for the enhanced withdrawal is almost the same as the duration over which the constant pension drops in value by 50. The annual income based on you taking 35 of your remaining pension pot in drawdown. The calculator assumes an annual charge of 1 is deducted from your fund.

Pension Minimum and Maximum Pension. The amount remaining in your pension pot after taking the lump sum. The pension of an individual who retired prior to 1 January 2016 on the basis of the 7th Pay Commission can be ascertained using a Pension Calculator.

Pension Drawdown Calculator Start planning your pension withdrawals with our drawdown calculator.

Taxable Income Formula Calculator Examples With Excel Template

How To Calculate What I Will Really Need For Retirement Quora

How To Calculate What I Will Really Need For Retirement Quora

Retirement Planning For A Small Business Owner In Canada

How To Calculate What I Will Really Need For Retirement Quora

How To Calculate What I Will Really Need For Retirement Quora

How To Calculate What I Will Really Need For Retirement Quora

How Do Dividends Affect Social Security Benefits

How To Calculate What I Will Really Need For Retirement Quora

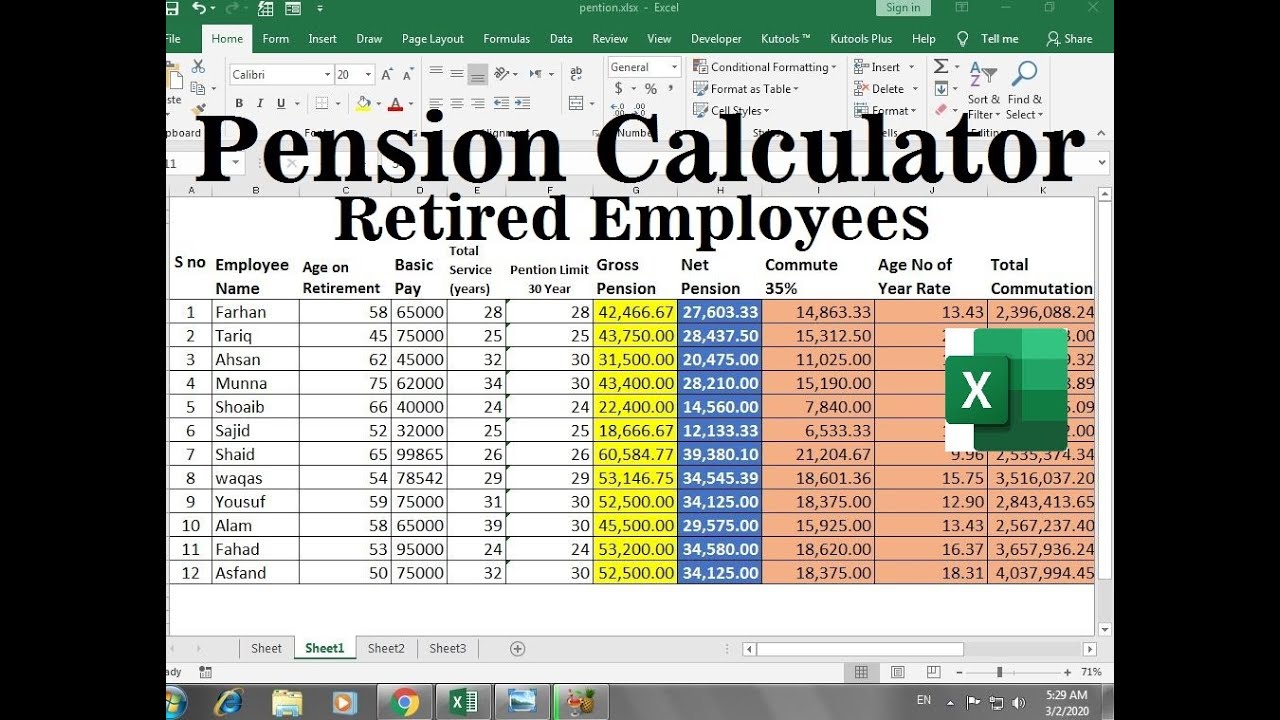

Pension And Commutation Calculator In Excel For Retired Employees Youtube Pensions Employee Calculator

Pension Plans Compare And Buy High Return Retirement Plans

Fers Retirement Calculator 6 Simple Steps To Estimate Your Federal Pension Retirement Calculator Federal Retirement Retirement

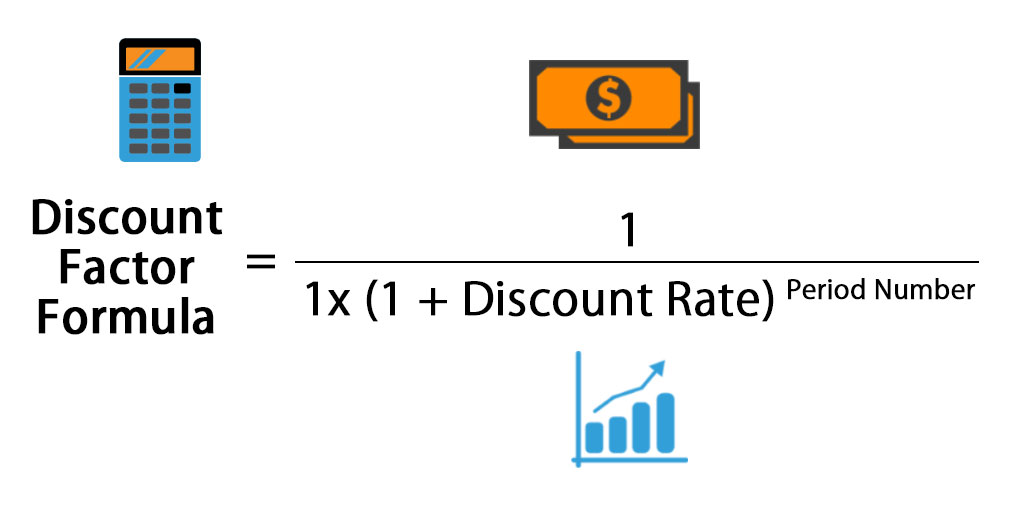

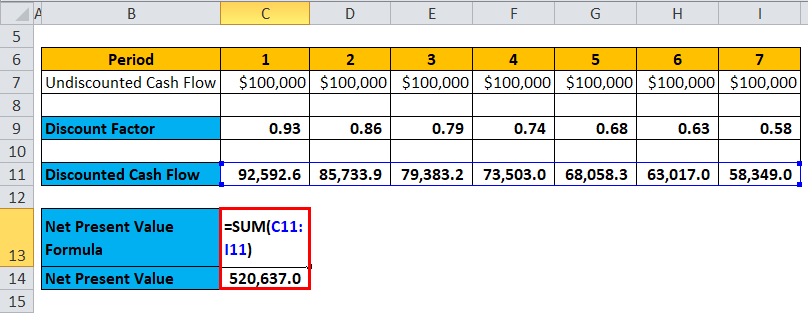

Discount Factor Formula Calculator Excel Template

Discount Factor Formula Calculator Excel Template

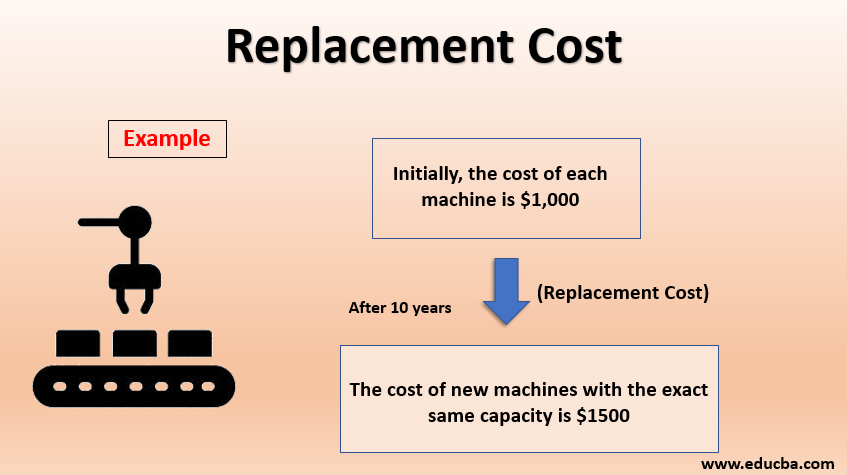

Replacement Cost How To Calculate The Replacement Cost Of A Firm

Online Pension Calculator 2020 Pakistan Retirement Calculator With Pen Retirement Calculator Pensions Calculator

Pension Plans Compare And Buy High Return Retirement Plans